Billionaire Ray Dalio has made the case for investing in gold as interest rates continue to fall and central banks print more money, resulting in devalued currencies.

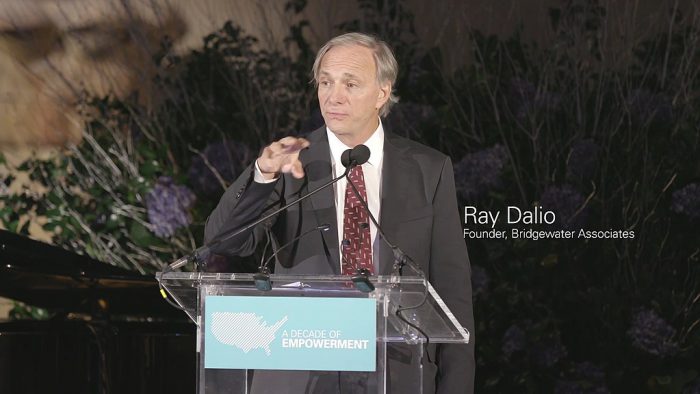

In a recent LinkedIn post, the founder of Bridgewater Associates wrote about monetary policy and the markets over the last 50 years. He said investors have been over-investing in stocks and other equity-like assets that will most likely see diminishing returns.

“The world is leveraged long, holding assets that have low real and nominal expected returns that are also providing historically low returns relative to cash returns. I think these are unlikely to be good real-returning investments.”

He also cited historical shifts in the geopolitical and macroeconomic climate, such as in the Great Depression and World Wars, to explain the coming “paradigm shift” that will soon face the economy. He said the financial crisis was the last major “paradigm shift” and blamed unsustainable growth rates as a root cause.

Dalio said the best investments are those that “do well when the value of money is being depreciated and domestic and international conflicts are significant, such as gold.” He said that it may be “risk-reducing and return-enhancing” for investors to add the precious metal to their portfolio. “In paradigm shifts, most people get caught overextended doing something overly popular and get really hurt,” he wrote. “On the other hand, if you’re astute enough to understand these shifts, you can navigate them well or at least protect yourself against them.”

Dalio isn’t the only hedge-fund heavyweight singing the praises of gold. Famous investor Paul Tudor Jones put gold as his favorite investment for the next few years. “I think one of the best trades is going to be gold. If I had to pick my favorite [bet] for the next 12 to 24 months, it’d probably be gold,” he said during a recent Bloomberg Markets interview.

The price of gold rose 0.7% into Thursday afternoon, to around $1,430 per ounce.

The arguments supporting gold apply to Bitcoin, as well. The current inflationary policies are, according to former Wall Street portfolio manager Travis Kling “brazenly bullish for a non-sovereign, hardcapped supply, global, immutable, decentralized digital store of value,” by which he meant BTC. The cryptocurrency is immune to 3rd party inflationary measures and is not controlled by a central authority. Any economic mishap caused by central bankers means that cryptocurrencies, in addition to gold, will see massive injections of capital.

Now is the time to take advantage of the sustained growth we have been seeing in the gold market. Indicators are showing that these bullish trends will continue, giving you an excellent opportunity for immediate growth while protecting your assets against future economic downturns. Don’t miss out on this opportunity. Act now and reap the benefits.

The post Head Of World’s Largest Hedge Fund Says ‘Paradigm Shift’ In Markets Make Gold A Top Investment appeared first on Regal Assets.