The crypto asset market is highly emotional, full of noise and thus incredibly hard to navigate. This has created significant information asymmetry among participants, which can be a boon to investors who can be level headed and get proper signal. We are at an inflection point in a market that shows institutions are coming as critical infrastructure continues to come online. Most notably the launching of CME Futures in 2017, Fidelity Digital Assets in 2018, and now ICE’s BAKKT in 2019.

The crypto asset market has since been primarily dominated by retail investors but certainly has shown niche hedge funds in the mix as well. Interestingly enough, this once in a lifetime market has shown that not only has the average Joe not taken advantage of buying and selling opportunities, but even some of the most prominent hedge funds in the space did not have proper risk management.

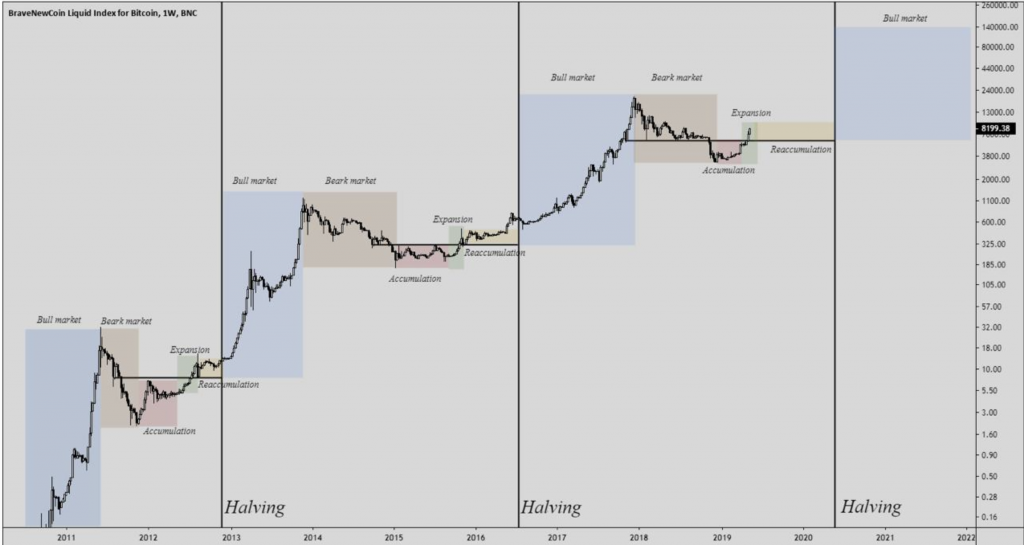

If you are reading this article around the date of publishing, it is time you take notice of where we may be in the current market cycle. The chart below shows the past 3 Bitcoin market cycles, which consist of bull markets, bear markets and accumulation phases. Based on this chart, it appears we are entering a final re-accumulation phase before the next large bull market which would likely propel Bitcoin far higher than the previous $20,000 all time high.

It’s important to understand that this chart is not to be taken as gospel but more as a basic education reference point to help you understand market cycles. The re-accumulation phase may very well be shorter (or longer) than shown in the image.

Again, this market is highly emotional and causes most investors to focus on short term price action instead of gathering high quality information and positioning themselves properly for more significant midterm or long-term price action. The crypto asset market and associated high quality assets will continue to appreciate in value; don’t miss out on this once in a lifetime opportunity due to low quality information and short term thinking.

Feel free to reach out to me for any questions or clarifications about the above information, I am here to help.