NEW ANALYSIS REAFFIRMS BITCOIN’S STRENGTH AS LONG TERM INVESTMENT; FOLLOWS IN GOLD’S FOOTSTEPS

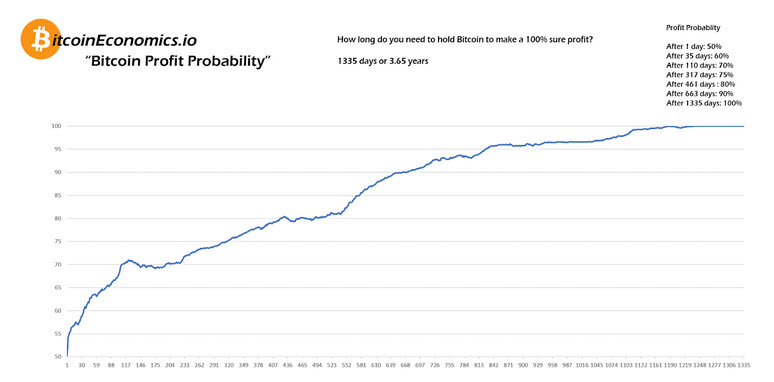

A new study indicates that Bitcoin (BTC) holders make a profit after an average of 1,335 days – which equates to roughly three years and eight months. The data was released earlier this week by BitcoinEconomics.io, and the cycle lengths shown roughly correlate to the various reward halving events.

The chart (shown below) essentially considers the amount of time between different peaks and how long it would take an investor to profit if they bought at the previous cycle’s peak.

This means that a 100% definite profit would have taken a maximum of 1,335 days, which relates to the bull market run that occurred late in 2013 when Bitcoin price surged to $1,150. If an investor bought at that price, the peak of that cycle, then it would have meant it took until early 2017 before the Bitcoin price finally broke that level again.

Seeing as this chart is looking at the market extremes, missing the peak of that rally would have resulted in a drastically reduced wait for a profit. Holding Bitcoin for 317 days would have given a 75% chance of profit. You’d have a 60% chance of profit if Bitcoin was held for 35 days, and the likelihood that you were up over any single day was 50%.

If that sounds like a long time, comparable data for the stock market is exponentially longer. To contrast, an investor would have needed to hold their position for 23 years to achieve a sure profit on the S&P 500. This makes it clear that not only is Bitcoin a safe, long term storage of wealth, but it is a reliable vehicle for your wealth if you are looking to turn a profit quickly.

It’s also notable that the analysis looked purely at the chance of profit and not the scale of that profit. When Bitcoin is on a bull run, the profits there dwarf those achievable on the stock market indices. A real world example from this year is the Greyscale Bitcoin Investment Trust, which outperformed everything else so far in 2019 with appreciation of almost 300% to date.

In addition to Bitcoin, Gold has also been an extremely strong performer this year and is presently a hot topic among traders. Bullish signs continue this week and leading investors have been speaking out on the merits of the precious metal. Mark Mobius, founding partner of Mobius Capital Partners, appeared on CNBC earlier this week and recommended that investors hold 10% of their portfolios in physical gold.

The latest price targets have the Gold price reaching the $1,600 mark before the end of the year. As global trade policy uncertainty continues, Gold looks a solid bet to keep building on it’s bullish momentum.

INVESTORS UNNERVED AT MORE WARNING SIGNALS IN STOCK MARKET

Earlier this week, a powerful warning signal revealed itself as the stock market got turned upside down.

Value stocks, or those with low multiples and stable fundamentals, significantly outperformed their growth counterparts. This type of shift is unnerving to investors because “momentum stocks”, or those defined by their large growth expectations relative to the broader market, have outperformed value names in recent years. A rotation away from these stocks could result in a downturn for the broader market.

Over the past 5 years, momentum stocks have blown away their value counterparts. Most of the top-performing S&P 500 stocks this year are growth names. Seven of the 10 best-performing stocks in the benchmark — including Chipotle Mexican Grill, Advanced Micro Devices and MarketAxess Holdings — have a much higher valuation relative to the broader index, FactSet data shows.

Monday’s session was the complete opposite to the year’s trend, however. This, coupled with geopolitical trade uncertainty, casts a dark forecast over the markets for the coming months.

LEADING INVESTOR SAYS ‘GOLD IS THE WAY TO GO’

Mark Mobius, founding partner of Mobius Capital Partners, appeared on CNBC earlier this week and recommended that investors hold 10% of their portfolios in physical gold.

“Physical gold is the way to go, in my view, because of the incredible increase in money supply,” said Mobius.

“All the central banks are trying to get interest rates down, they are pumping money into the system. Then, you have all of the cryptocurrencies coming in, so nobody really knows how much currency is out there,” he told CNBC’s “Street Signs” on Friday.

Mobius said that investors should place at least 10% of their portfolios in physical gold, with the rest invested in dividend yielding equities. That’s especially true if the dollar gets weaker.

“People are going to finally realize that you got to have gold, because all the currencies will be losing value,” he added.

Gold can retain its value much better than other forms of currency, and is traditionally a safe haven during market volatility. A weaker dollar tends to boost the price of gold as global trade in the yellow metal is denominated in U.S. dollars.

“At the end of the day, gold is a means of exchange. It’s a stable currency in some way,” said Mobius.

Now is the time to take advantage of the rising price of gold and protect yourself from stock market volatility. Indicators are showing that these bullish trends will continue in the gold markets, giving you an excellent opportunity for immediate growth and providing protection for your assets against future economic downturns. Don’t miss out on this opportunity. Act now and reap the benefits.

The post New Data Shows Every Bitcoin Holder Makes Profit After 1,335 Days; Gold Forecast Bullish appeared first on Regal Assets.